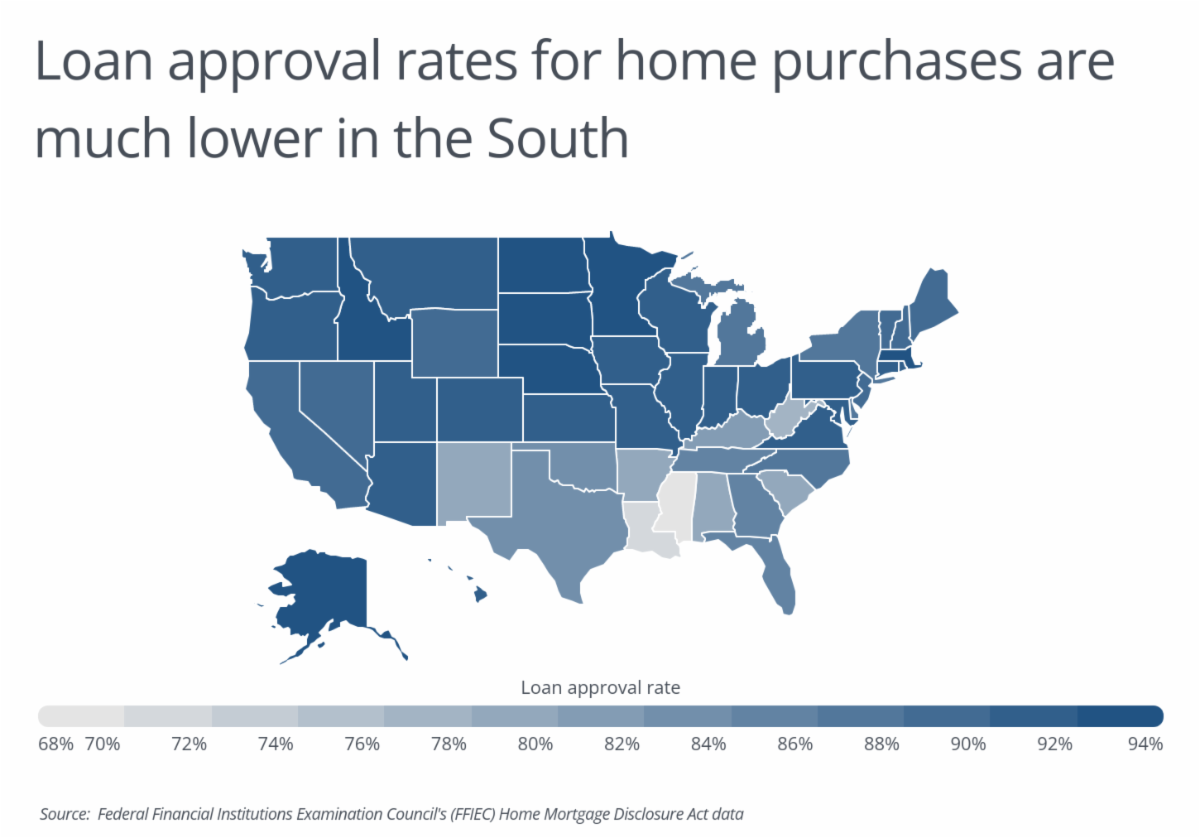

The 84.1% Georgia Home Purchase Loan Approval Rate Was the 11th Lowest in the U.S.

Friday, February 25th, 2022

Home buying during the pandemic has been a story of bidding wars, housing shortages, and rapidly increasing home prices. Despite this, record low interest rates encouraged millions of buyers to take out loans for new homes. According to loan-level mortgage data from the Home Mortgage Disclosure Act (HMDA), 86.3% of 2020 applicants were approved for home purchase mortgages, with a median loan amount of $235,000.

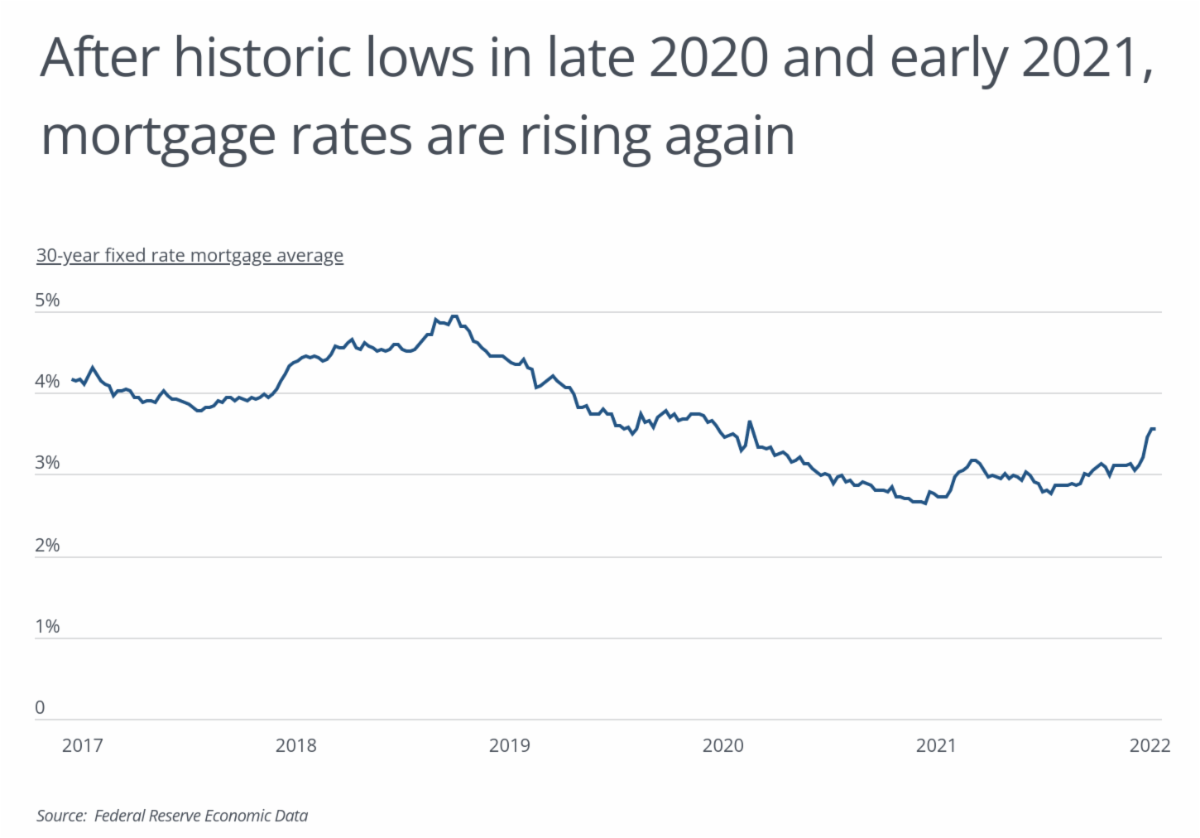

In the second half of 2020, 30-year fixed mortgage rates fell below 3% for the first time in history and then continued to fall. Due in part to emergency actions by the Federal Reserve, 30-year rates dipped as low as 2.66% at the end of 2020. Total mortgage applications—including home purchases, home improvements, and refinancing—soared in response, increasing from 17.5 million in 2019 to 25.6 million in 2020, according to HDMA data. Conventional home purchase loan applications numbered 5.8 million in 2020, accounting for 23% of all applications. In the last few months, rates have begun to rise again, which will likely put downward pressure on both applications and home prices.

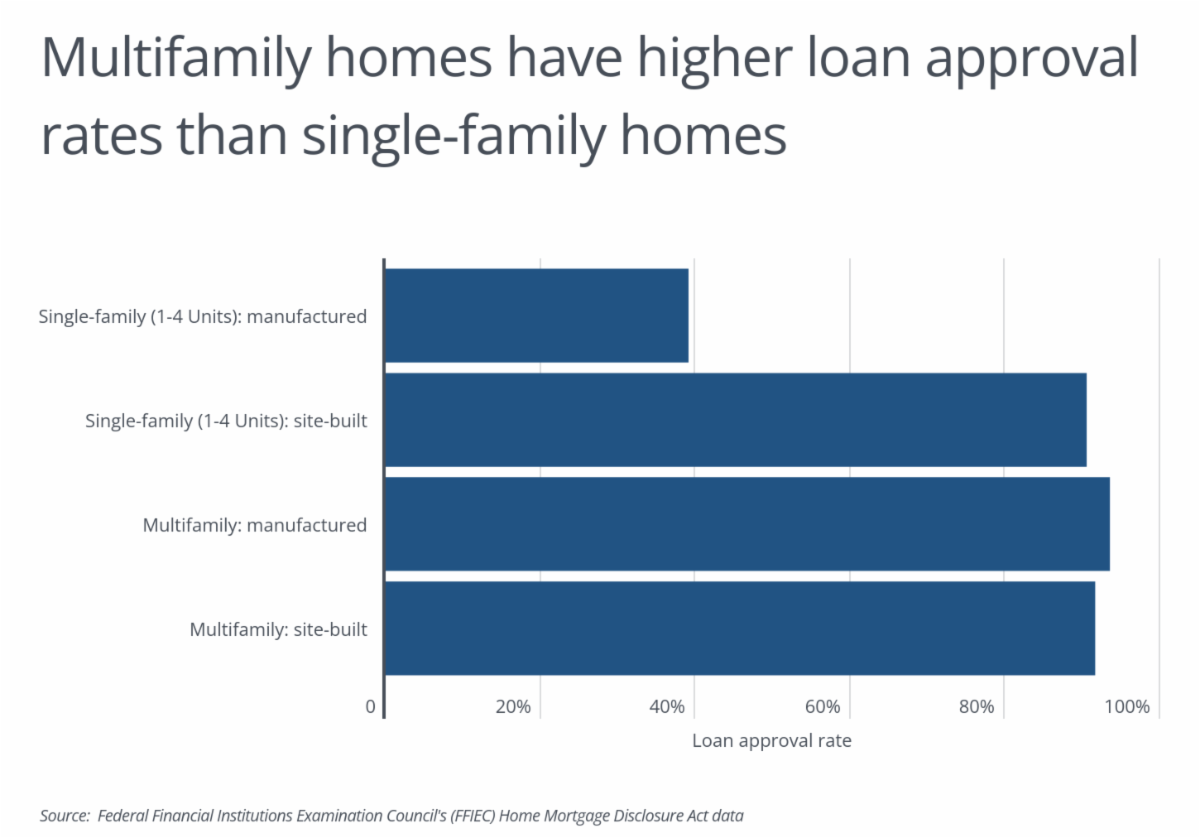

While conventional home purchase mortgage applications for single family homes increased by 6% from 2019 to 2020, to 5.8 million, multifamily loan applications declined, from 30,462 in 2019 to 25,654 in 2020. This trend reflects a growing preference for single family housing amid the COVID-19 pandemic. Although single family loan applications are far more common, the mortgage approval rates for multifamily homes, which are more likely to be owned by investors, are higher overall. The approval rate for site-built multifamily homes was 91.6% in 2020, slightly higher than the 90.5% approval rate for site-built single family homes. With regards to manufactured housing, while loans for multifamily manufactured homes have similar approval rates as those for site-built homes, a majority of single family manufactured mortgages are denied. These applicants tend to be lower income, living in rural areas, and many do not own the underlying land.

|